|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance to Take Cash Out: A Comprehensive GuideHomeowners often consider refinancing their mortgages to take cash out for various financial needs. This process involves replacing your existing mortgage with a new one, often with different terms, allowing you to access a portion of your home’s equity in cash. Understanding Cash-Out RefinancingCash-out refinancing is a popular option for those looking to leverage their home’s equity. It involves taking out a new mortgage for a larger amount than the existing loan and receiving the difference in cash. How It WorksWhen you refinance to take cash out, you essentially pay off your current mortgage and replace it with a new one. The new loan amount is higher than the outstanding balance, and you receive the difference in cash. Benefits

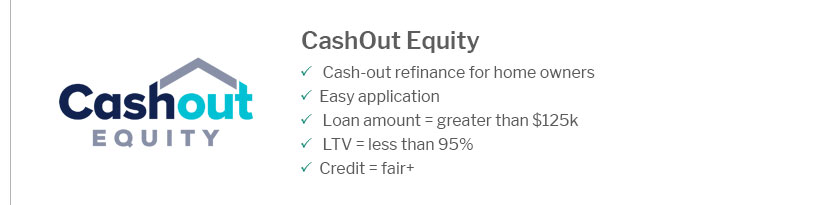

Factors to ConsiderBefore deciding on a cash-out refinance, consider the following: Equity RequirementsYou need substantial equity in your home to qualify. Typically, lenders require you to maintain at least 20% equity after the cash-out. Credit ScoreA good credit score can help secure better terms and rates. Check your score and work on improving it if necessary. For more information on securing favorable terms, explore the best FHA refinance lenders available. Application ProcessThe application process for a cash-out refinance involves several steps:

Frequently Asked QuestionsWhat is the difference between a cash-out refinance and a home equity loan?A cash-out refinance replaces your existing mortgage with a new one for a larger amount, while a home equity loan is a second loan in addition to your existing mortgage. Can I refinance if my home value has decreased?It might be challenging to qualify for a cash-out refinance if your home value has decreased, as you may not have enough equity. What are typical closing costs for a cash-out refinance?Closing costs generally range from 2% to 5% of the loan amount. It's important to factor these into your decision-making process. Exploring options for refinancing can be daunting, but understanding the best FHA refinance rates can help you make an informed decision. https://www.experian.com/blogs/ask-experian/what-is-a-cash-out-refinance/

A cash-out refinance is a way to tap into your home equity by replacing your current mortgage with a new one. https://www.chase.com/personal/mortgage/education/financing-a-home/guide-cash-out-refinances

A cash-out refinance allows a homeowner to use the equity in their home to get funds. A cash-out refinance replaces your existing mortgage. https://www.creditkarma.com/home-loans/i/cash-out-refinance

A cash-out refinance lets you tap into the equity you've built up in your home by paying off your existing mortgage and replacing it with a larger mortgage ...

|

|---|